BTC Price Prediction: Navigating Current Support Tests Toward Potential 2026 Rally

#BTC

- Technical Positioning: BTC testing crucial support near Bollinger lower band with bullish MACD divergence

- Institutional Catalysts: Regulatory approvals and corporate investments providing fundamental support

- Price Targets: Analyst projections ranging from $123,000 near-term to $200,000 by 2026

BTC Price Prediction

BTC Technical Analysis: Critical Support Test Underway

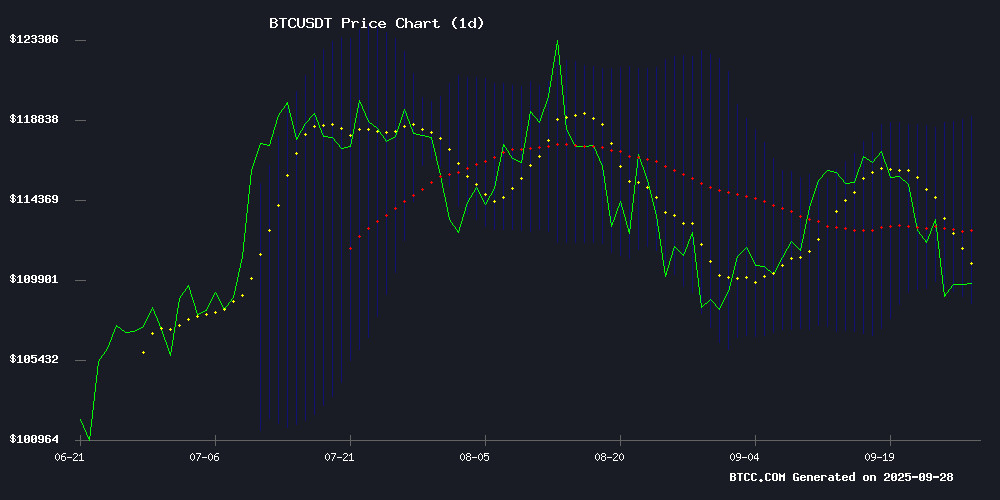

BTC is currently trading at $109,436, below its 20-day moving average of $113,804, indicating short-term bearish pressure. The MACD shows bullish momentum with a positive histogram of 1,824.60, though both MACD lines remain in negative territory. Bollinger Bands position the current price NEAR the lower band at $108,529, suggesting potential oversold conditions.notes: 'The convergence near Bollinger's lower band often precedes significant price movements. A hold above $108,500 could trigger a rebound toward the middle band at $113,804.'

Mixed Sentiment as Institutional Developments Offset Technical Weakness

Market sentiment reflects a tug-of-war between bullish institutional developments and near-term technical concerns. Positive catalysts include Crypto.com's CFTC approval for U.S. derivatives and Google's investment in Bitcoin mining infrastructure. However, warnings about corporate crypto treasuries and Metaplanet's 41% decline create headwinds.observes: 'The $200,000 price predictions for 2026 contrast with current support tests. Institutional adoption continues, but traders are watching the $108,500 level closely.'

Factors Influencing BTC's Price

Bitcoin Price Could Reach $200K by June 2026, Analyst Predicts

Bitcoin (BTC) remains a focal point for investors as market analysts project its future trajectory. Despite a recent 6% weekly decline, economist and Bitcoin author Timothy Peterson forecasts a 50% chance BTC could hit $200,000 by June 2026. His analysis, shared on X, hinges on historical trends and seasonal patterns, particularly the bullish cycle from October to June.

Peterson's Median Bitcoin Yearly Price Path chart suggests October often marks the start of significant gains. Achieving $200,000 would require average monthly returns of 7%, or a 120% annualized increase. The analyst also highlights a 50% probability BTC could set a new all-time high as early as November 2025.

Two scenarios emerge: an aggressive surge to $240,000 or a more tempered climb. The outlook underscores Bitcoin's potential for rapid appreciation, driven by historical performance and institutional interest.

Can Bitcoin Reach $200,000 by End of 2025? Analysts Weigh In

Bitcoin's potential to surge to $200,000 by the end of 2025 is gaining traction among market observers. Galaxy Digital CEO Mike Novogratz posits that such a rally would require a significant catalyst, such as a shift in Federal Reserve leadership. "This could be the most bullish outcome," Novogratz noted, while cautioning that aggressive rate cuts might carry risks for the U.S. economy.

Eric Trump echoed bullish sentiments, predicting a strong Q4 for Bitcoin without specifying price targets. Historical trends, he argued, favor robust crypto performance in the final quarter of the year. While $1 million projections remain speculative, the $200,000 threshold appears within the realm of possibility should macroeconomic conditions align.

Crypto.com Gains CFTC Approval for Margined Derivatives in U.S.

Crypto.com has secured regulatory approval from the U.S. Commodity Futures Trading Commission (CFTC) to offer margined derivatives, marking a significant expansion into the regulated U.S. market. The platform's Derivatives Clearing Organization (DCO) amendment and Futures Commission Merchant (FCM) license strengthen its position in the crypto derivatives sector.

The approval enables Crypto.com Derivatives North America (CDNA) to provide margined products, including Bitcoin and other cryptocurrency derivatives, to both retail and institutional clients. This move transitions Crypto.com from a retail-focused exchange to a dual-licensed derivatives platform.

"Another significant milestone for @cryptocom as we have received approval from the @CFTC for derivatives licenses in the United States," the company announced on September 27, 2025. The expanded DCO license now includes crypto perpetuals alongside fully-collateralized derivatives.

Bitcoin Tests Critical Support Levels Amid Market Uncertainty

Bitcoin's price action has reached a pivotal juncture, with the $109,000 support level serving as the battleground between bulls and bears. The cryptocurrency's recent breakdown below the 100-day moving average at $113,400 has injected fresh volatility into markets, mirroring historical patterns observed during transitional phases.

Traders remain divided on whether current price action signals a consolidation period or the beginning of a broader downturn. The narrowing range between the 100-day ($113,000) and 200-day ($104,000) moving averages reflects mounting indecision, with technical indicators suggesting limited downside unless significant selling pressure emerges.

Google Invests in Cipher Mining to Power AI-Ready Data Centers

Google has taken a strategic 5.4% stake in Bitcoin mining firm Cipher Mining, signaling a convergence of AI infrastructure and cryptocurrency operations. The deal, announced September 26, 2025, includes a $1.4 billion guarantee for Fluidstack's lease obligations at Cipher's Texas facility, with Google receiving warrants for 24 million Cipher shares.

Cipher's Barber Lake site currently delivers 168MW of computing power, expandable to 500MW, creating a dual-purpose infrastructure for both Bitcoin mining and AI cloud services. This move positions Google at the forefront of high-performance computing while maintaining exposure to crypto mining operations.

Bitcoin (BTC) Price Prediction: Parabolic Rally to $123K Possible in Three Months

Bitcoin shows signs of an impending explosive rally, currently trading around $109,433 with a marginal 24-hour dip of 0.11%. Historical fourth-quarter performance, oversold technical indicators, and high-profile endorsements are fueling speculation about its trajectory.

Market participants remain vigilant as BTC's trading volume hits $30.47 billion in the past day, signaling active participation despite recent volatility. Analysts note key support levels and oversold conditions could catalyze a rebound.

Eric Trump forecasts a parabolic surge, predicting Bitcoin could reach $1 million by 2025. His bullish stance cites quantitative easing and BTC's historical strength in Q4 cycles.

Crypto Treasuries Companies May Crash Markets Nearly 80%, Like Dotcoms!

Ray Youssef, founder of peer-to-peer platform NoOnes, draws parallels between today's crypto treasuries boom and the dotcom bubble of the early 2000s. The late 1990s saw internet companies attract massive investments despite lacking fundamentals—a scenario now repeating with crypto, DeFi, and Web3 projects.

Corporate crypto holdings, once hailed as proof of institutional conviction, may become a liability. Youssef warns that treasury-dependent firms could trigger a market reset by offloading Bitcoin and other assets during failures. The coming shakeout may mirror the dotcom crash's 80% collapse, though disciplined players could emerge stronger by acquiring discounted blue-chip cryptocurrencies.

NYDIG Urges Bitcoin Treasury Firms to Abandon 'Misleading' mNAV Metric Amid Landmark Merger

Strive Asset Management's acquisition of Semler Scientific marks the first-ever merger between two Digital Asset Treasuries (DATs), creating a combined entity holding over 10,900 BTC. The deal highlights growing institutional interest in bitcoin as a treasury asset, but also exposes flaws in how these firms are valued.

NYDIG's research team has called for the elimination of the mNAV (market cap divided by crypto holdings) metric, calling it 'misleading' at best and 'disingenuous' at worst. The metric fails to account for operational businesses or other assets held by DATs, while often incorporating unexercised convertible debt in share count calculations.

Greg Cipolaro, NYDIG's Global Head of Research, argues that convertible debt represents a more onerous liability than simple share issuance, as debt holders would demand cash repayment rather than equity conversion during volatility. The critique comes as bitcoin treasury strategies gain mainstream traction among corporations.

Metaplanet (MTPLF) Stock Plummets 41% MTD Despite Bitcoin's Strength, Analysts Hold Buy Rating

Metaplanet Inc., a Tokyo-based firm holding over 25,500 BTC, saw its stock nosedive 41% in September 2025 even as Bitcoin traded near record highs. Shares closed at ¥517 on September 26, continuing a downward trend that contrasts sharply with crypto market performance.

Benchmark Equity Research maintained its 'Buy' rating with a ¥2,400 price target for 2026, while Capital Group emerged as the largest shareholder with an 11.45% stake. The divergence between Metaplanet's stock and Bitcoin's price action highlights company-specific concerns including share dilution and valuation questions.

OTC-listed MTPLF shares have fallen approximately 40% year-to-date, with notable volatility including a 14% single-day drop in July. Analysts attribute the weakness to internal factors rather than broader market conditions, creating a rare disconnect between corporate Bitcoin exposure and equity performance.

Digital Asset Treasuries Struggle as Stock Prices Fall Below Crypto Holdings

Companies emulating MicroStrategy's Bitcoin acquisition strategy face mounting pressure as their stock valuations dip below the value of their cryptocurrency holdings. Seven firms—including Semler Scientific, ETHZilla, and Metaplanet—now trade at market capitalizations lower than their BTC reserves, prompting emergency share buybacks.

The trend reveals cracks in the digital asset treasury (DAT) model. Firms that announced crypto pivots earlier this year saw temporary stock surges followed by sustained declines. Several are now borrowing up to $250 million to repurchase shares, a move market observers interpret as a last-ditch effort to stabilize prices.

Michael Saylor's MicroStrategy remains the outlier, with its aggressive BTC accumulation strategy still commanding investor confidence. But for smaller players, the third quarter has exposed the risks of tying corporate value too closely to volatile crypto assets. Their predicament mirrors broader turbulence in crypto-linked equities as markets question the sustainability of Bitcoin-heavy balance sheets.

Bitcoin Struggles in Q3 as Key Technical Level Comes Into Focus

Bitcoin closed its third-worst week of the year with a 5% decline, underperforming equities, metals, and the US dollar. The cryptocurrency eked out a 1% gain for Q3 but faces headwinds from options expirations and technical resistance.

Friday's $17 billion options expiry saw the max pain price anchor spot BTC near $110,000. The short-term holder cost basis at $110,775 now serves as critical support—a level Bitcoin has tested multiple times during this bull market. The April exception saw prices plunge to $74,500 during market turmoil.

Analysts are watching whether Bitcoin maintains its higher highs and higher lows pattern. The breakdown below the 100-day exponential moving average raises questions about trend sustainability, though historical seasonality suggests Q3 weakness often precedes year-end rallies.

Is BTC a good investment?

Based on current technical and fundamental factors, BTC presents a mixed short-term outlook but maintains strong long-term potential. The current price below the 20-day MA suggests near-term caution, while institutional developments support longer-term growth.

| Metric | Current Value | Interpretation |

|---|---|---|

| Price | $109,436 | Below 20-day MA |

| 20-day MA | $113,804 | Resistance level |

| Bollinger Lower Band | $108,529 | Critical support |

| MACD Histogram | +1,824.60 | Bullish momentum building |

For investors with a 12-18 month horizon, current levels may represent accumulation opportunities. Short-term traders should monitor the $108,500 support level closely.